Printable Withholding Tax Table – 2022 income tax withholding tables and instructions for employers. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. How do i use an income tax withholding table? 2022 income tax withholding tables and instructions for employers.

Desiree Is Hired As A Counselor Making 35 Per Hour And Is Paid

Printable Withholding Tax Table

Enter personal information (a) first name and middle initial. The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount to add to a nonresident alien employee's wages for figuring income tax withholding are included in pub. Here’s what you need to know for the 2023 withholding tax tables:

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $539,900 For Single Filers And Above $647,850 For Married Couples Filing Jointly.

For employees, withholding is the amount of federal income tax. If you don’t pay your tax through withholding, or don’t pay enough The amount withheld is paid to the irs in your name.

$0 $10,275 $0 + $10,275 $41,775 $1,027.50 + $41,775 $89,075 $4,807.50 + $89,075 $170,050 $15,213.50 +.

There are seven federal income tax rates in 2023: It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for withholding on distributions of indian gaming profits to tribal members. All net unearned income over a threshold amount of $2,500 for 2023 is taxed using the marginal tax and rates of the child’s parents.

The Last Revision To Wisconsin's Withholding Tables Took Place In April.

If too much is withheld, you will generally be due a. $11,000 $44,725 $95,375 $182,100 $231,250 $346,875 $2,900 $10,550 $14,450 $0 $2,200.00 $10,294.00 $32,580.00 $74,208.00 $105,664.00 $186,601.50 $0 $1,100.00 $5,147.00 $16,290.00 $37,104.00. 2022 tax table k see the instructions for line 16 to see if you must use the tax table below to figure your tax.

The Federal Income Tax Withholding Tables Changed Effective January 1, 2021.

The revised withholding tables reflect this rate cut along with individual income tax rate cuts that were implemented in 2019 and 2020, as well as adjustments due to inflation. The withholding calculator can help you figure the right amount of withholdings. Taxable income ($) base amount of over not over tax ($) plus.

The Best Way To Do This Is Through Circular E From The Irs.

Tax tables are adjusted each year for inflation. Employer probably withholds income tax from your pay. The irs income tax withholding tables and tax calculator for the current year.

Your Withholding Is Subject To Review By The Irs.

Find tax withholding information for employees, employers and foreign persons. To calculate withholding tax, you’ll need the following information: Withholding tax tables revised starting january 1, 2022 the withholding tables and alternate methods of withholding have been revised.

The Withholding Tables And Alternate Method Are Found In Wisconsin.

The federal withholding income tax table for 2022 had lower income brackets. The governor signed 2021 wisconsin act 58 which reduced the individual income tax rate for 2021. $0 $10,275 $0 + $10,275 $41,775 $1,027.50 + $41,775 $89,075 $4,807.50 + $89,075 $170,050 $15,213.50 +.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return And May Owe A Penalty.

Since the federal income tax withholding brackets can change annually, reviewing these tables every year is essential. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $693,750 for married couples filing jointly.

Tax Tables Are Used To Calculate The Tax You Owe Based On Your Filing Status And Taxable Income.

Each employee’s gross pay for the pay period. This document is a helpful guide for small business owners and businesses in general. There are seven federal income tax rates in 2022:

Revised Withholding Tax Table Bureau of Internal Revenue

Weekly Tax Withholding Chart Federal Withholding Tables 2021

The Treasury Department Just Released Updated Tax Withholding Tables

RR 11 2018 Annex D Revised Withholding Tax Table 2018 2022

CASE STUDY INFORMATION Helga Hemp owns Born Again

Look BIR releases revised withholding tax table Philippines Daily

2021 Federal Withholding Tax Tables Publication 15 Federal

Wage Bracket Method Tables 2021 Federal Withholding Tables 2021

Printable 2021 Federal Tax Table Federal Withholding Tables 2021

Federal Withholding Tables 2023 Federal Tax

Federal Tax Withholding Tables Monthly Awesome Home

IRS Withholding Chart Federal Withholding Tables 2021

Federal Withholding Tax Tablerida Tax Table Rate 2021 Federal

Desiree is hired as a counselor making 35 per hour and is paid

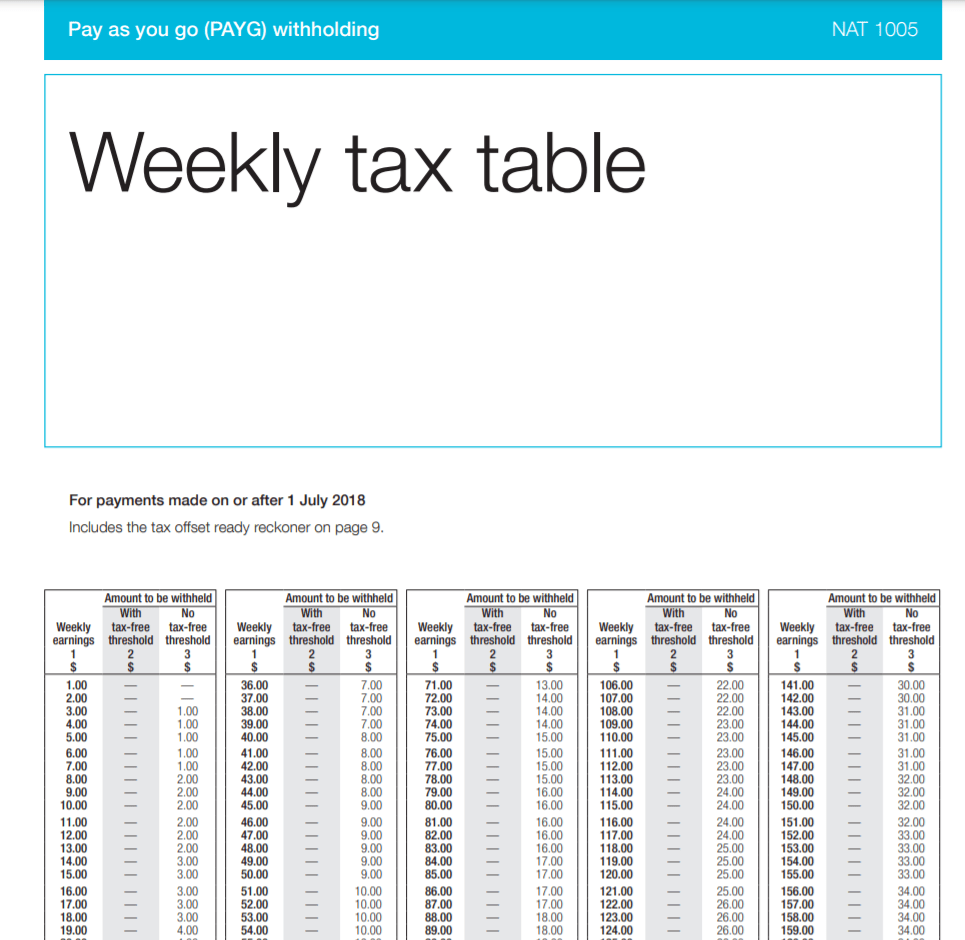

Weekly tax table 2018 19 NAT 1005 Pay as you go (PAYG) withholding